Traveling is a delightful adventure that broadens our horizons, but it also comes with uncertainties Travel Insurance. Amidst the excitement of planning a trip, one crucial consideration often takes a backseat – travel insurance. It’s the safety net that can make all the difference in unforeseen circumstances. However, the dilemma lies in choosing between annual and single-trip travel insurance. In this comprehensive guide, we’ll explore the intricacies of both options, helping you make an informed decision tailored to your unique travel needs.

Annual Travel Insurance: A Year-Long Shield

Annual travel insurance, also known as multi-trip insurance, covers an entire year. It’s a cost-effective choice for frequent travelers who take multiple trips annually. This option ensures continuous protection, allowing you to jet-set without purchasing an additional policy for each trip.

- Cost Efficiency: Annual policies can be more economical for frequent travelers than buying individual policies for each trip.

- Convenience: One-time purchase covers multiple trips, saving time and effort.

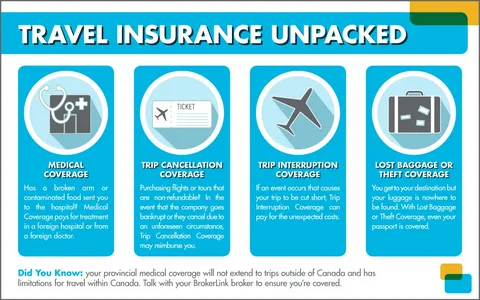

- Comprehensive insurance provides a wide range of coverage options, including trip cancellation, medical emergency, and baggage loss.

Cons:

- Upfront Cost: While cost-effective in the long run, the initial premium may be higher than a single-trip policy.

- Unused Coverage: If you don’t travel frequently, you might pay for coverage you don’t use.

Single-Trip Travel Insurance: Tailored for Specific Journeys

Single-trip insurance, as the name suggests, covers just one trip. It’s ideal for occasional trips or a one-time adventure. This type of policy offers flexibility and customization based on each trip’s specific requirements.

Pros:

- Tailored Coverage: Allows you to customize coverage based on the destination, duration, and activities of a specific trip.

- Affordability: Can be more cost-effective for infrequent travelers or short trips.

- No Unused Coverage: You only pay for the coverage you need for a particular journey.

Cons:

- Repeated Purchases: If you travel frequently, buying an insurance policy for each trip can be time-consuming.

- Higher cumulative cost: Over time, purchasing individual policies for multiple trips may cost more than an annual policy.

Making the Right Choice:

Frequency of travel:

If you’re a frequent traveler, an annual policy is the most affordable option. Continuous coverage without repeated purchases is practical. On the other hand, if your travels are sporadic, a single-trip policy might be more suitable, allowing you to tailor coverage to each individual trip.

Duration of the trip:

Consider the average length of your trips. If they tend to be short and infrequent, a single-trip policy with tailored coverage might be more economical. For extended or multiple trips throughout the year, an annual policy provides comprehensive and continuous protection.

Type of Coverage Needed:

Identify the coverage elements critical to your peace of mind Health Caree Tips. Annual policies typically offer comprehensive coverage, including trip cancellation, medical emergency, and baggage loss. If you need specific coverage for unique activities or destinations, a single-trip policy allows you to customize protection accordingly.

Budget considerations:

Compare the costs of an annual policy against the cumulative expenses of multiple single-trip policies. While the upfront cost of an annual policy may seem higher, it often proves more cost-effective for frequent travelers in the long run.

Conclusion:

Choosing between annual and single-trip travel insurance requires careful examination of your travel habits, preferences, and budget. Each option has its merits, and the right choice depends on your unique circumstances. Whether you opt for the continuous protection of an annual policy or the flexibility of single-trip coverage, the key is to prioritize your peace of mind while traversing the globe. By understanding the nuances of each type of insurance and aligning them with your travel patterns, you can embark on your journeys with confidence, knowing that you have the right protection in place. Budget Considerations: A Comprehensive Guide to Financial Planning

Introduction:

In today’s dynamic economic landscape, individuals, businesses, and organizations must navigate their financial journeys with prudence and foresight. One of the foundational elements of any successful financial plan is a well-thought-out budget. In this comprehensive guide, we will discuss budget considerations. We will explore the importance of budgeting, key components, strategies for effective budgeting, and how to adapt your budget to changing circumstances.

Budgeting is Critical:

Financial stability:

Budgeting as a tool for financial stability. Financial crises and emergencies can be prevented with budgeting.

Goal Achievement:

Aligning budgeting with short-term and long-term financial goals. Case studies of successful individuals and businesses who attribute their success to disciplined budgeting.

Decision making:

How budgeting aids informed decision-making. Avoiding impulsive financial choices through a well-structured budget.

Key Budget Components:

Income assessment:

Strategies for accurately estimating and tracking income. Differentiating between fixed and variable income sources.

Expense Category:

Classifying expenses into essential and discretionary categories. Case studies illustrate successful expense management strategies.

Emergency funds:

The critical role of emergency funds in budgeting. Determine the appropriate size of an emergency fund.

Debt management:

Integrating debt repayment into budget planning. Techniques for minimizing and managing debt effectively.

Strategies for Effective Budgeting:

Zero-Based Budgeting:

Understanding zero-based budgeting principles. Implementing zero-based budgeting for personal and business finances.

Envelope system:

How the envelope system controls discretionary spending. Tips for successfully implementing the envelope system.

Technology Tools:

Utilizing budgeting apps and software for streamlined financial management. Reviews of popular budgeting tools and features.

Regular Reviews and Adjustments:

The importance of regularly reviewing and adjusting budgets. Signs that a budget needs revision.

Adapting Budgets to Changing Circumstances:

Economic downturns:

Strategies for budgeting during economic recessions or downturns. Case studies of businesses that successfully weathered economic storms through effective budget adjustments.

Life changes.

Adapting budgets to major life events such as marriage, parenthood, or retirement. Financial planning considerations for unexpected life changes.

Inflation and Cost of Living Adjustments:

Incorporating inflation considerations into long-term to make effective cost of living adjustments without compromising financial goals?

Conclusions:

In conclusion, budget considerations are at the core of financial well-being. Whether managing personal finances or overseeing a business’s financial health, a comprehensive understanding of budgeting principles and effective implementation strategies is paramount. This guide serves as a roadmap for individuals and organizations seeking monetary stability, goal achievement, and adaptability in an ever-changing economic landscape. By prioritizing budget considerations, we pave the way for a secure and prosperous business future.