Traveling can be an exhilarating experience, but unforeseen circumstances can quickly turn a dream vacation into a nightmare Travel Insurance. That’s where travel insurance comes into play, offering a safety net against unexpected events. When choosing the right travel insurance, one common dilemma arises: Should you opt for an annual or single-trip plan? In this comprehensive guide, we’ll compare annual and single-trip travel insurance to help you determine which option perfectly suits your unique needs.

Understanding the basics:

Annual travel insurance:

- Coverage Duration: Annual travel insurance covers an entire year, allowing multiple trips.

- Cost Efficiency: If you’re a frequent traveler, an annual policy can often be more cost-effective than purchasing separate single-trip plans for each journey.

- Convenience: With a yearly plan, you won’t need to worry about buying insurance whenever you embark on a trip. It offers continuous coverage for all your travels throughout the year.

Single-trip travel insurance:

- Coverage Duration: This type of insurance is designed for a specific trip, providing coverage for that journey only.

- Flexibility: Single-trip insurance is ideal for infrequent travelers or those planning a one-off vacation. It allows you to customize coverage based on each trip’s specific needs.

- Lower Initial Cost: Single-trip plans might seem more affordable initially, but their cumulative cost can surpass an annual policy for frequent travelers.

Key considerations:

Frequency of travel:

- Frequent Travelers: An annual plan is cheaper if you travel multiple times yearly.

- Infrequent Travelers: For those who embark on occasional trips, a single-trip policy offers flexibility without committing to a year-long plan.

Cost Analysis:

- Annual Plan: Calculate the cost of a yearly plan against the cumulative cost of individual single-trip policies for your typical travel frequency.

- Single-Trip Plans: Assess whether the lower upfront cost of single-trip plans aligns with your travel habits and preferences.

Coverage Needs:

- Comprehensive Coverage: Consider the extent of coverage needed for each trip. If you require complete protection, an annual plan might offer more extensive benefits.

- Tailored Coverage: Single-trip plans allow you to customize coverage for each specific journey, ensuring you pay for what you need.

Conclusion:

Choosing between annual and single-trip travel insurance depends on your travel habits, budget, and preferences. Frequent travelers may find a yearly plan more convenient, while infrequent travelers prefer single-trip policies. Ultimately, the decision boils down to personal circumstances. Evaluating your frequency, cost, and coverage needs will help you make an informed choice that aligns with your unique travel lifestyle.

Understanding Worldwide Travel Insurance Comprehensive Coverage

Traveling the world is a thrilling adventure but uncertain. From unexpected medical emergencies to travel disruptions, comprehensive coverage is paramount. Worldwide travel insurance is a safety net, protecting against various unforeseen events. In this in-depth exploration, we’ll delve into the intricacies of what worldwide travel insurance covers, providing a detailed understanding of the benefits and protections it affords travelers.

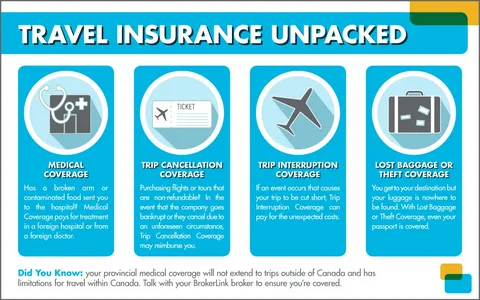

Medical Coverage: Safeguarding Your Health Around the Globe

Emergency medical expenses:

– Worldwide travel insurance typically covers emergency medical expenses, including hospitalization, surgery, and outpatient care.

– This coverage extends to injuries, illnesses, and pre-existing conditions, ensuring travelers receive necessary medical attention without excessive costs.

Evacuation and repatriation:

– In a severe medical emergency, worldwide travel insurance often includes coverage for evacuation to the nearest suitable medical facility.

– Repatriation benefits cover the transportation of the insured back to their home country, ensuring continuity of care and comfort.

Emergency dental care:

– Dental emergencies are unpredictable, and worldwide travel insurance often covers emergency dental treatments, relieving unexpected oral health issues.

Trip Cancellation and Interruption: Guarding Against Unforeseen Disruptions

Trip cancellation:

– Worldwide travel insurance can reimburse non-refundable trip expenses if a journey is canceled due to covered reasons such as illness, injury, or unforeseen circumstances like natural disasters.

Trip interruptions:

– If a trip is interrupted for valid reasons outlined in the policy, such as a family emergency or a covered event at the travel destination, worldwide travel insurance can reimburse the unused portion of the trip.

Travel Delay and Missed Connections: Navigating Unplanned Hurdles

Travel delays:

– Delays are a standard part of travel, and worldwide insurance often compensates for additional expenses incurred due to delayed departures, such as accommodation and meal costs.

Missed Connections:

– When a traveler misses a connecting flight or transport due to circumstances beyond their control, worldwide travel insurance can cover the costs of rebooking and rearranging travel plans.

Lost, Stolen, or Damaged Belongings: Protecting Your Valuables Abroad

Baggage loss:

– Worldwide travel insurance typically covers lost or stolen baggage, reimbursing travelers for their belongings.

Personal Items and Valuables:

– Valuables such as electronics, jewelry, and significant documents are often covered, protecting travelers from theft or damage.

Personal Liability and Legal Assistance: Navigating Legal Matters Abroad

Personal liability:

– Worldwide travel insurance may include personal liability coverage, offering financial protection in case the insured is found legally responsible for causing injury or property damage to others.

Legal Assistance:

– If travelers encounter legal issues while abroad, some policies assist with legal expenses and access to appropriate representation.

Natural Disasters and Political Evacuations: Responding to Unforeseen Events

Natural disasters:

– Worldwide travel insurance can offer coverage in natural disasters, providing assistance and reimbursement for expenses incurred due to disruptions caused by earthquakes, hurricanes, or other catastrophic events.

Political Evacuations:

– In politically unstable regions, some policies cover evacuation expenses to ensure travelers’ safety in the face of civil unrest, political upheaval, or other security concerns.

Adventure and Hazardous Activities: Tailoring Coverage for Risky Pursuits

Adventure sports coverage:

– For travelers engaging in adventure sports and activities, worldwide travel insurance can be customized to include coverage for injuries or accidents related to these high-risk pursuits.

Hazardous Activities:

– Policies may vary regarding the coverage of hazardous activities, so adventure enthusiasts must choose a plan that aligns with their planned activities.

Coverage Exclusions: Understanding the Limitations and Restrictions

Pre-existing conditions:

– Some policies may exclude coverage for pre-existing medical conditions, emphasizing the importance of understanding the terms and conditions before purchasing.

High-risk destinations:

– Certain travel destinations deemed high-risk may have limited coverage, necessitating additional considerations for travelers venturing into these areas.

How to Choose the Right Worldwide Travel Insurance: A Guide for Travelers

Assessing Personal Needs:

– Consider your travel habits, health conditions, and the activities you plan to engage in to determine coverage that aligns with your needs.

Comparing Policies:

– Research and compare policies from reputable insurers, paying attention to coverage limits, exclusions, and customer reviews.

Understanding Terms and Conditions:

– Thoroughly read and understand the policy terms and conditions, including coverage limitations, exclusions, and the claims process.

Customized coverage:

– For travelers with unique needs, inquire about customization options to tailor the policy to specific requirements.

Conclusion:

Worldwide travel insurance is a vital companion for globetrotters, providing a safety net against unforeseen events that can disrupt or endanger their journeys. From medical emergencies to travel delays and lost belongings, these policies ensure travelers can explore the world with complete peace of mind. By understanding the intricacies of worldwide travel insurance, individuals can make informed decisions, selecting policies that align with their unique travel preferences, destinations, and activities. Ultimately, investing in the right coverage is essential to responsible and enjoyable global exploration.