Travelling opens up a world of possibilities and experiences, but an unforeseen emergency can turn a dream vacation into a nightmare Travel Insurance. That’s where travel insurance comes in, providing a safety net that offers peace of mind during your journey. This comprehensive guide explores emergency coverage. It will help you understand the importance of travel insurance and how to choose the right policy for your needs.

Understanding the basics

What is travel insurance?

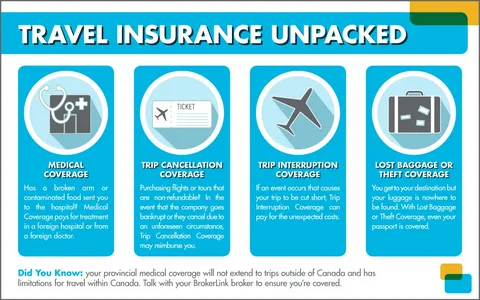

Travel insurance is a financial safety net designed to protect travellers from unexpected events that may disrupt their plans. These events range from medical emergencies and trip cancellations to lost luggage and natural disasters.

Travel insurance types

Medical Coverage: Explore medical coverage details, including emergency medical expenses, evacuation, and repatriation.

Trip Cancellation/Interruption: Understand how this coverage reimburses non-refundable trip costs in case of unexpected events like illness, death, or natural disasters.

Lost or Delayed Luggage: Examining coverage for lost, stolen, or delayed baggage and personal belongings.

Travel Delays: Discuss compensation for unexpected travel delays and how it covers additional expenses.

Emergency Assistance: Highlighting the importance of 24/7 emergency assistance services, including medical advice and coordination of services.

The Importance of Emergency Medical Coverage

Health risks abroad

Discuss international travel health risks, including exposure to new diseases and medical facilities in foreign countries.

Emergency medical expenses

Explain the significance of emergency medical expense coverage and how it can alleviate the financial burden of unexpected medical treatment.

Medical Evacuation and Repatriation: Elaborating on the necessity of coverage for medical evacuation and repatriation, especially in remote or underdeveloped regions.

Evaluating Trip Cancellation/Interruption Coverage

Common Reasons for Trip Cancellation/Interruption

We examine common scenarios that may lead to trip cancellations or interruptions and the financial implications for travellers.

Reimbursement eligibility

They clarify the conditions under which travellers can be reimbursed for non-refundable trip expenses and the documentation required.

Protect Your Belongings with Luggage Coverage

Understanding luggage coverage

Exploring coverage details for lost, stolen, or delayed luggage and personal belongings.

Valuables and Exclusions

We advise on precautions to protect valuable items and policy exclusions for certain belongings.

Dealing with travel delays

Causes of travel delays

Discuss common reasons for travel delays, including weather, technical issues, and strikes.

Compensation and Additional Expenses

Understanding how travel insurance can compensate for delayed flights and cover additional expenses incurred due to delays is essential.

The Role of Emergency Assistance Services

Importance of 24/7 assistance

I emphasize the crucial role of emergency assistance services in providing round-the-clock support for medical emergencies and other unforeseen events.

Coordination and communication

A. Exploring how assistance services coordinate with local providers and communicate with travellers to ensure swift and practical assistance.

Conclusion

In conclusion, travel insurance is vital to trip planning, offering peace of mind and financial protection in an unforeseen emergency. By understanding the nuances of emergency coverage, travellers can make informed decisions when selecting a policy that suits their needs. Whether you’re embarking on a leisurely vacation or a business trip, investing in travel insurance ensures you can enjoy your journey. This is without worrying about unexpected setbacks.

Evaluating World Nomads Travel Insurance: A Comprehensive Review

Travelling is an exhilarating adventure but comes with uncertainties. Globetrotters turn to travel insurance providers to mitigate risks associated with unforeseen events. World Nomads is a prominent name in the travel insurance industry, known for its global coverage and catering to adventurous travellers. This comprehensive review will explore the critical aspects of World Nomads travel insurance. We’ll evaluate its offerings, strengths, and potential drawbacks to help you make an informed decision.

Overview of World Nomads

Company Background

It provides a brief history and background of World Nomads, including its inception, mission, and growth in the travel insurance market.

Target audience:

A. Identify the specific demographic or type of traveller that World Nomads caters to and assess whether their coverage aligns with the needs of various travellers.

Coverage options

Types of Coverage

I am detailing the various types of coverage offered by World Nomads, such as medical coverage, trip cancellation/interruption, baggage protection, and more.

Adventure and extreme activities

Assessing World Nomads’ reputation for covering adventure and extreme activities is a crucial selling point for many adventure-seeking travellers.

Policy Inclusions and Exclusions

Inclusions

I highlight World Nomads’ key features and benefits. These include emergency medical expenses, evacuation, trip cancellation, and valuable belongings coverage.

Exclusions

They are investigating the fine print to identify any notable exclusions or limitations that travellers should know when considering World Nomads travel insurance.

Cost and value for money

Premiums and Pricing Structure

They analyze World Nomads’ pricing structure, including premiums for different coverage levels and pricing factors.

Value for money

We are evaluating whether World Nomads coverage justifies the cost, considering the overall value and benefits offered to travellers.

Customer Reviews and Satisfaction

Online Reviews and Ratings

We are examining customer reviews and ratings from various online platforms to gauge World Nomads policyholder satisfaction.

Common Feedback Themes

They identify recurring themes in customer feedback, both positive and negative, to provide a well-rounded perspective on the World Nomads user experience.

Claims Process and Customer Support

Filing a claim

Outline the steps in filing a claim with World Nomads and assess their claims process efficiency.

Customer support and quality

We are evaluating World Nomads’ customer support’s responsiveness and helpfulness in addressing queries, concerns, and claims.

Worldwide accessibility and emergency assistance

Global coverage

They are assessing World Nomads’ coverage reach, including the countries and regions covered by their policies.

Emergency Assistance Services

We detail World Nomads’ emergency assistance services, such as 24/7 helplines, medical advice, and coordination of emergency services.

Comparisons with Other Travel Insurance Providers

Industry benchmarks

I compared World Nomads to leading travel insurance providers regarding coverage, pricing, and customer satisfaction.

Conclusion

In conclusion, World Nomads travel insurance stands out as a comprehensive, adventure-friendly option for travellers seeking reliable coverage. You can determine whether World Nomads fits your travel insurance needs by exploring its coverage options, cost-effectiveness, customer satisfaction, and overall performance. Remember that the appropriate travel insurance provider varies based on individual preferences, trip plans, and adventures.